The Era of Critical Scarcity: Silver and Strategic Metals in the Age of AI, Electrification, and Monetary Dislocation

“That which is lacking cannot be supplied.”

— Kohelet (Ecclesiastes) 1:15

Executive Summary

The global financial and industrial landscape is currently navigating a period of profound structural transformation, characterized by the convergence of three distinct but mutually reinforcing macro-thematic forces: the "AI Arms Race" which is necessitating an unprecedented expansion of power infrastructure; the maturation of Next-Generation Energy technologies, specifically Solid-State Batteries (ASSB) and the Hydrogen Economy; and a rapid deterioration of sovereign fiscal health that is prompting a re-evaluation of national monetary reserves. This comprehensive analysis posits that the half-decade between 2025 and 2030 will be defined by a decoupling of critical metal prices from traditional GDP cycles, driven instead by inelastic industrial demand, physical scarcity, and monetary repricing.

The narrative of "thrifting", the gradual reduction of precious metal content in industrial applications, is reaching its physical and thermodynamic limits. In the silver market, the commercialization of Samsung SDI’s solid-state battery technology represents a reversal of this trend, introducing a new application that increases per-vehicle silver consumption by orders of magnitude. Simultaneously, the solar photovoltaic sector faces a "thrifting wall," where efficiency gains from substituting silver with copper are meeting severe reliability barriers, thereby sustaining and even increasing silver consumption in high-efficiency cells like TOPCon and HJT.

Copper has emerged as the absolute bottleneck of the digital economy. The exponential power density requirements of AI-optimized data centers have created a demand shock that legacy mining supply, constrained by declining ore grades in Chile and Peru and catastrophic operational failures in Indonesia, cannot meet. This imbalance suggests a permanent upward repricing of the red metal, with major financial institutions identifying $10,000 per tonne as a new structural floor rather than a cyclical ceiling.

In the Platinum Group Metals (PGM) complex, a sharp divergence is occurring. Platinum faces severe supply deficits and rapidly depleting above-ground stocks, buoyed by the nascent hydrogen economy which promises to create a new demand vertical independent of the internal combustion engine. Conversely, Palladium’s future is tethered to the longevity of the hybrid vehicle, creating a precarious medium-term outlook despite short-term resilience due to geopolitical supply risks.

Finally, the monetary dimension of these metals is being reactivated by global liquidity trends and legislative proposals in the United States to revalue gold reserves to market prices. Such a move would not only alter the balance sheet of the world's largest economy but would fundamentally reset the implied value of all hard assets, creating a feedback loop between industrial scarcity and monetary debasement.

The Silver Paradigm Shift: Solid-State Batteries and the Industrial Demand Shock

The global silver market is currently navigating a pivotal transition. For the past decade, the prevailing narrative has been one of "thrifting" - the industrial imperative to reduce silver content per unit in electronics and photovoltaics to minimize costs. However, 2025 marks the emergence of technologies where silver’s unique conductivity and chemical stability are performance-critical, rendering demand increasingly price-inelastic. The most disruptive of these developments is the commercialization of All-Solid-State Batteries (ASSB), specifically the design pioneered by Samsung SDI.

The Samsung SDI Architecture: A Quantum Leap in Material Intensity

Samsung SDI has unveiled a breakthrough in electric vehicle (EV) battery technology that promises to dramatically reshape the landscape of energy storage and, by extension, the industrial demand profile for silver. This "super-gap" technology utilizes a proprietary anode-less architecture that relies on a Silver-Carbon (Ag-C) nanocomposite layer.

The Role of the Ag-C Nanocomposite Layer

Unlike traditional lithium-ion batteries that utilize graphite or silicon-graphite anodes to store lithium ions, Samsung’s solid-state design employs a sulfide solid electrolyte (specifically an argyrodite-based sulfide) and a distinct anode-less configuration. In this architecture, the Ag-C layer plays a critical, irreplaceable role. It regulates the deposition of lithium metal during the charging process, ensuring uniform plating on the current collector. This regulation is vital for preventing the formation of lithium dendrites—needle-like metallic structures that can puncture the separator and cause short circuits or thermal runaway in conventional batteries.

The inclusion of silver in the anode composite enhances the battery's Coulombic efficiency and cycle life stability. Silver’s exceptional electrical conductivity facilitates rapid electron transfer, while its ability to form a solid solution with lithium aids in the smooth deposition and dissolution of lithium metal during charge and discharge cycles.

Quantitative Analysis of Silver Loading

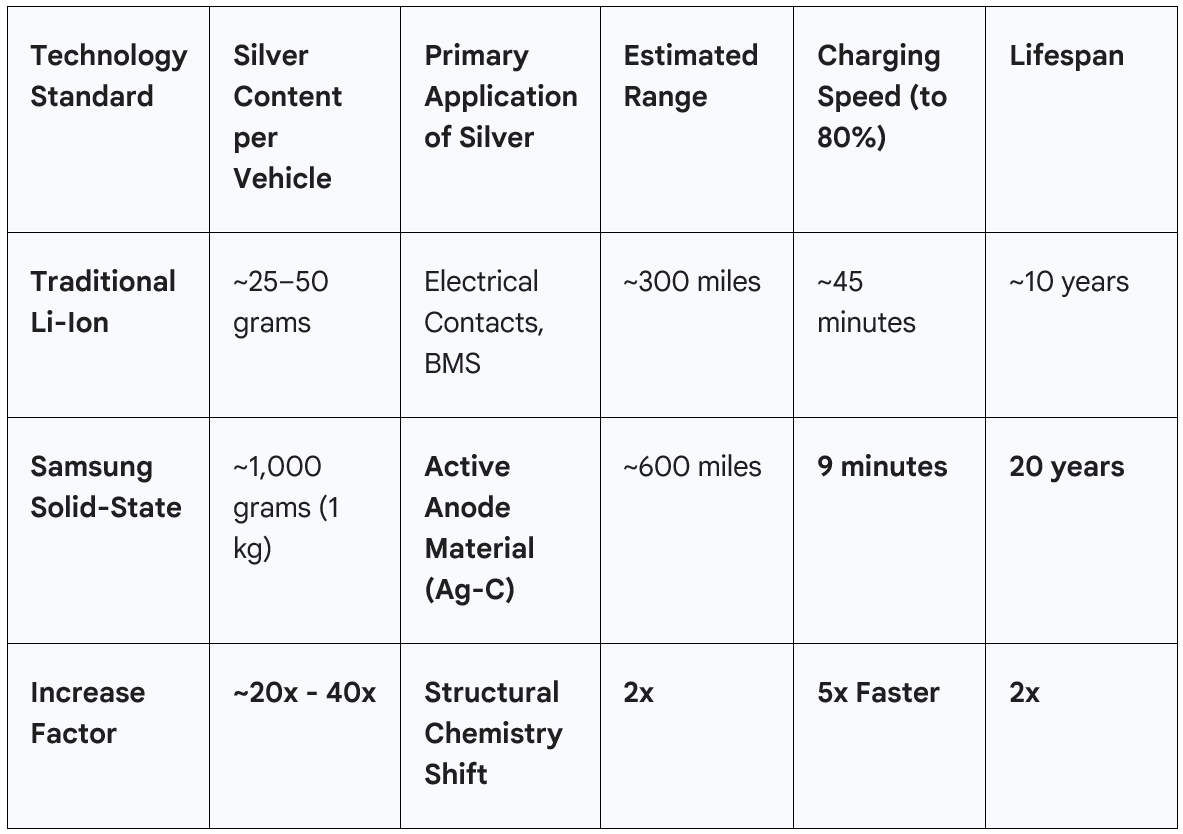

The material intensity of this design is orders of magnitude higher than current EV technologies. Industry analysis and technical breakdowns of the Samsung cell structure suggest the following consumption metrics:

Per Cell Consumption: Technical estimates indicate that each solid-state battery cell contains up to 5 grams of silver.

Per Vehicle Consumption: A typical high-performance electric vehicle requires a battery pack with a capacity of approximately 100 kWh. Such a pack is comprised of roughly 200 individual cells. Consequently, the total silver content per vehicle is estimated at 1 kilogram (1,000 grams).

To contextualize this figure, it is necessary to compare it with the current industry standard. Modern lithium-ion EV batteries utilize approximately 25 to 50 grams of silver per vehicle. This silver is primarily found in the battery management system (BMS), electrical contacts, and control electronics, rather than in the active electrochemistry of the cell itself.

The Samsung SDI architecture therefore represents a 20-fold to 40-fold increase in silver utilization per vehicle. This is not a marginal increase; it is a structural step-change that transforms the automotive sector from a moderate consumer of silver into potentially its largest single-end-market.

Table 1: Comparative Silver Intensity in Electric Vehicle Batteries

Performance Justification for High-Cost Inputs

Critics might argue that the addition of 1 kilogram of silver, costing approximately $1,000 to $1,600 at 2025 prices, would render these batteries economically unviable. However, the performance benefits offered by the Samsung ASSB create a compelling value proposition for the premium vehicle segment, where performance metrics often trump raw material costs.

The Samsung solid-state battery offers:

Energy Density: A gravimetric energy density of 500 Wh/kg, nearly double that of the 270 Wh/kg typical of mainstream lithium-ion batteries.16 This allows for a lighter battery pack or significantly extended range.

Range: A driving range of 600 miles on a single charge.

Charging Speed: The ability to charge to 80% capacity in just 9 minutes. This rapid charging capability addresses one of the primary barriers to EV adoption: range anxiety and charging downtime.

Longevity and Safety: A lifespan of 20 years and significantly enhanced safety due to the non-flammable solid electrolyte.

The elimination of the graphite anode and the bulky cooling systems required for liquid electrolytes (due to the higher thermal stability of the solid-state design) allows manufacturers to offset the cost of the silver. Furthermore, for luxury automotive marques like BMW, the ability to market a vehicle with a 600-mile range and 9-minute charge time justifies a premium price point that can absorb the higher input costs.

The Supply Shock: Modeling the 16,000 Tonne Scenario

The implications of this intensity are profound when extrapolated across global automotive production. The electric vehicle market is scaling rapidly, and even a modest penetration rate of this silver-intensive technology would create a demand shock that the current mining supply chain is ill-equipped to handle.

If Samsung’s technology, or similar Ag-C designs adopted by competitors, achieves a market penetration of just 20% of global EV production (estimated at approximately 16 million vehicles per year in the late 2020s), the incremental annual silver demand would be staggering.

Calculation: 16,000,000 vehicles * 20% penetration * 1 kg silver/vehicle = 3,200,000 kg or 3,200 metric tons.

Some credible industry estimates suggest that if 20% of total global car production (approx. 80 million vehicles) were to eventually transition to this technology, the demand could reach 16,000 metric tons annually.

To place this 16,000-tonne figure in perspective, total global silver mine production currently hovers around 25,000 to 26,000 metric tons per year. A single industrial application consuming more than 60% of global mine supply is unprecedented and would necessitate a complete restructuring of the silver market, driving prices to levels that incentivize the recycling of every available ounce of scrap silver and the development of lower-grade deposits.

Commercialization Timeline and Pilot Operations

This demand shock is not a distant theoretical possibility; the industrial machinery is already in motion. Samsung SDI has moved beyond laboratory research and established a pilot line at its Suwon R&D Center in South Korea, producing prototypes as of late 2023.

Partnerships: Samsung has entered into a trilateral agreement with BMW Group and Solid Power to validate the technology. Samsung will supply ASSB cells, while BMW will develop the modules and packs for integration into next-generation evaluation vehicles.

Target Dates: Validation vehicles are expected to be on the road by late 2026. Mass production and commercial sales are targeted for 2027.

Early Adoption: Reports indicate that ASSBs will also debut in smaller Samsung devices, such as the Galaxy Ring fitness tracker, during 2026. This allows Samsung to test the supply chain and performance in real-world conditions before scaling to automotive volumes.

This timeline suggests that the physical "offtake" of silver, the purchasing of metal to stockpile for pilot runs and initial mass production, will begin impacting the market in 2025–2026, preceding the actual rollout of the vehicles. Battery manufacturers must secure their raw material supply chains years in advance, meaning the price impact will be felt well before the first solid-state EV is sold to a consumer.

Photovoltaics: The Limits of Thrifting and the "Reliability Wall"

While solid-state batteries represent the future shock to silver demand, the solar photovoltaic (PV) sector remains the current dominant industrial consumer. The solar industry is currently undergoing a massive technological shift from PERC (Passivated Emitter and Rear Cell) technology to TOPCon (Tunnel Oxide Passivated Contact) and HJT (Heterojunction) cells. This transition has fundamentally altered the silver consumption profile of the industry, pushing it toward higher loadings per watt despite intense efforts to economize.

The Transition to Silver-Intensive Architectures

For years, the solar industry successfully offset the growth in panel installations by reducing the amount of silver used per cell, a process known as "thrifting." However, the physics of the new high-efficiency cell architectures demands higher silver loadings to minimize resistance and maximize electron capture.

PERC Cells: The previous industry standard, PERC cells, typically consume about 10 milligrams (mg) of silver per watt of power produced.

TOPCon Cells: These cells require approximately 13 mg of silver per watt, representing a 30% to 40% increase in silver intensity compared to PERC. As of 2024, TOPCon technology has become the market leader, accounting for nearly 80% of global PV manufacturing.

HJT Cells: Heterojunction cells are even more silver-intensive, requiring up to 22 mg of silver per watt.

Even with the implementation of advanced thrifting techniques, such as Zero Busbar (0BB) technology, which removes the main busbars in favor of thinner interconnect wires, and Laser Selective Emitter (SE) technology, which improves contact quality, the sheer volume of solar installations is overwhelming these efficiency gains. Global solar installations are surging, with 2025 expected to surpass the record highs of 2024, driven largely by aggressive clean energy mandates in China and the United States. Consequently, the solar sector's total silver consumption is projected to reach 246 million ounces in 2025, with a potential peak of 261 million ounces in 2026.

The Copper Plating Alternative: Promise and Peril

As silver prices have rallied, surpassing $75 per ounce, the economic pressure to replace silver with cheaper materials like copper has intensified. Research institutions like the University of New South Wales (UNSW) and Fraunhofer ISE have made significant strides in developing copper plating techniques that can theoretically replace silver contacts.

UNSW researchers have demonstrated a process involving a 1-micrometer copper plating layer on TOPCon cells. This technique uses a "bias-assisted light-induced plating" (LIP) method to deposit copper, which is then capped with a thin layer of silver or tin to prevent oxidation. The results showed that copper-plated cells could achieve efficiencies comparable to silver-pasted cells, with a relative efficiency increase of 0.39% in some tests due to reduced grid resistance.

The "Reliability Wall" and Corrosion Failure

Despite these laboratory successes, the mass adoption of copper plating faces severe "reliability walls" that prevent it from being a near-term solution to the silver deficit.

Corrosion Susceptibility: Copper is highly chemically active and susceptible to corrosion, particularly from environmental contaminants like sodium chloride (NaCl) and moisture. In damp-heat (DH) testing, which simulates long-term field exposure, unprotected copper contacts degrade rapidly. UNSW studies showed that standard copper-plated cells suffered an 80% relative reduction in efficiency after just 6 hours of damp-heat testing due to contaminant ingress, whereas silver contacts remained stable. While the new plating techniques improved this retention to 88.5%, the risk remains significantly higher than with inert silver pastes.

Process Complexity: The screen-printing of silver paste is a simple, high-throughput, and dry process that dominates the industry. In contrast, copper plating is a wet chemical process that requires complex steps: applying a masking layer to define the grid, plating the copper in a chemical bath, and then capping it with another metal. This introduces wastewater management issues and increases the complexity of the manufacturing line.

Adhesion and Long-Term Durability: Copper does not bond to the silicon wafer as naturally as fired silver paste. This leads to issues with contact adhesion over the 25-to-30-year operational life of a solar module. Delamination of the contacts would lead to catastrophic module failure, a risk that bankable Tier-1 solar manufacturers are unwilling to take.

The industry consensus, therefore, is that while copper plating is a viable long-term hedge, it is not "plug-and-play" ready for the massive scale of current global manufacturing. The "thrifting limit" has effectively been reached; further reductions in silver content threaten the reliability and bankability of the panels. Thus, for the 2025–2030 horizon, the solar industry remains structurally tethered to silver.

The Physical Silver Market Dislocation

The convergence of future battery demand and current inelastic solar demand is colliding with a rigid and increasingly fragile physical supply chain. The market is exhibiting classic signs of a "squeeze," where the price of physical metal decouples from paper derivatives.

Refinery Bottlenecks and "No Free Float"

A critical bottleneck has emerged not at the mine level, but at the refinery level. High demand for investment-grade products (1,000 oz bars and retail coins/bars) and industrial grains has overwhelmed refining capacity. Reports indicate backlogs of four weeks or more at major refineries. This means that even if raw doré bars (semi-pure alloy) are available from mines, there is a shortage of the high-purity .999+ fine silver required by industry and investors.

Market participants are increasingly noting that there is "no free-floating silver left," implying that the mobile inventories usually available to balance supply and demand fluctuations have been absorbed by long-term holders or industrial stockpiles.

Backwardation and Lease Rate Spikes

The stress in the physical market is quantifiable through two key financial indicators:

Backwardation: The silver market has experienced episodes of backwardation, a condition where the spot price of silver trades higher than futures contracts (e.g., the front-month contract). In a healthy market with ample supply, futures trade higher to account for storage and interest costs (contango). Backwardation is a signal of acute immediate scarcity; buyers are so desperate for physical metal now that they are willing to pay a premium over the price for delivery in the future.

Lease Rates: Silver lease rates, the interest rate paid to borrow physical silver, have spiked to levels between 20% and 30%, at times exceeding the lease rates for platinum. This indicates that bullion banks and vaults lack the unencumbered inventory to lend to industrial users or short sellers. When lease rates rise this high, it confirms that the "float" of the market has dried up.

Retail and Institutional Sentiment

Sentiment analysis from retail investment forums reveals a growing awareness of these industrial drivers among retail investors. Discussions focus heavily on the "Samsung narrative" and the disconnect between the paper price of silver and its strategic value. Retail investors are increasingly viewing silver not just as a monetary hedge, but as a "technology play" on the green energy transition. This grassroots accumulation adds another layer of demand that is less price-sensitive than traditional jewelry or silverware demand.

Copper: The Nervous System of the AI Economy

While silver battles scarcity in the energy transition, copper has emerged as the absolute bottleneck of the digital economy. Historically viewed as a cyclical asset that tracks global construction and GDP, copper is undergoing a rebranding to a strategic technology metal due to the rise of Artificial Intelligence (AI).

The AI Infrastructure Demand Shock

The proliferation of Generative AI models (like GPT-4 and its successors) requires a fundamental redesign of data center architecture. We are shifting from "storage-centric" cloud facilities to "compute-centric" AI factories, and this shift is incredibly copper-intensive.

Power Density and Copper Intensity

Legacy data centers typically operate with a power density of 4 to 10 kilowatts (kW) per server rack. In contrast, AI-optimized data centers, running high-performance GPU clusters (e.g., NVIDIA H100s or Blackwell architecture), require power densities of 30 to 100 kW per rack. This exponential increase in power density necessitates a complete overhaul of the electrical infrastructure within the data center:

Busbars and Distribution: To handle the massive amperage without overheating, data centers must replace standard wiring with heavy-gauge copper busbars and distribution units.

Cooling Systems: The thermal output of AI chips requires advanced cooling solutions, including liquid cooling loops and upgraded HVAC systems. These heat exchangers and piping systems are predominantly copper-based due to the metal's superior thermal conductivity.

Consumption Metrics: Industry analysis places copper usage for AI data center capacity at roughly 27 to 33 tonnes of copper per megawatt (MW) of installed capacity.

Scale: Hyperscale data center campuses are now being planned in the 100 MW to 1 GW range. A single 100 MW facility alone absorbs nearly 3,000 tonnes of copper for internal infrastructure, before accounting for external grid connections.

The Grid Connection Bottleneck

The "AI Arms Race" is effectively a race for power availability. Technology giants like Microsoft, Amazon, and Alphabet are competing for grid connections. Connecting gigawatt-scale AI campuses requires high-voltage transmission lines, massive transformers, and substations, all of which rely heavily on copper windings and cables. The International Energy Agency (IEA) estimates that grid expansion alone will be a primary driver of copper demand through 2035, and AI data centers are accelerating this timeline.

The Copper Supply Cliff: Geology and Geopolitics

While demand for copper is experiencing a step-change function due to AI, the supply side is facing a "perfect storm" of geological exhaustion and operational failure.

The Secular Decline in Ore Grades

The global copper industry is battling a secular decline in ore quality. Average global copper ore grades have fallen by approximately 40% since 1991, dropping from around 0.8% to 0.56%. This implies that miners must excavate, crush, and process significantly more rock to extract the same volume of metal. This increases energy consumption, water usage, and capital expenditures (CapEx), raising the "incentive price" required to justify new mine construction to over $10,000 per tonne.

Catastrophic Disruptions at Major Assets

Recent years have seen significant disruptions at the world's premier copper assets, removing expected tonnage from the market:

Grasberg (Indonesia): The world's second-largest copper mine suffered a major tunnel collapse and fatal mudslide, forcing the closure of its critical Block Cave operations. This disruption is expected to persist until Q2 2026, removing a substantial portion of global concentrate supply.

Chile (Codelco): State-owned giant Codelco, the world's largest copper producer, has struggled with persistent production downgrades. Operational issues, including tunnel collapses and water restrictions due to drought, have hampered output at its flagship El Teniente and Chuquicamata mines.

Peru: Political instability and community protests continue to threaten output in the world's second-largest copper producing nation, creating a risk premium for supply reliability.

Smelting Economics and the TC/RC Collapse

A critical disconnect has emerged between mine supply (concentrate) and smelting capacity. In 2025, Chinese smelters, which process over half the world's copper, faced a severe shortage of raw concentrate. This drove Treatment Charges and Refining Charges (TC/RCs), the fees miners pay smelters, to record lows, and even into negative territory in the spot market.

Implication: Negative TC/RCs mean smelters are effectively losing money on the processing fee to secure feedstock. This unsustainable dynamic forced major Chinese smelters to agree to a 10% production cut in 2026 to tighten the refined metal market and restore margins.

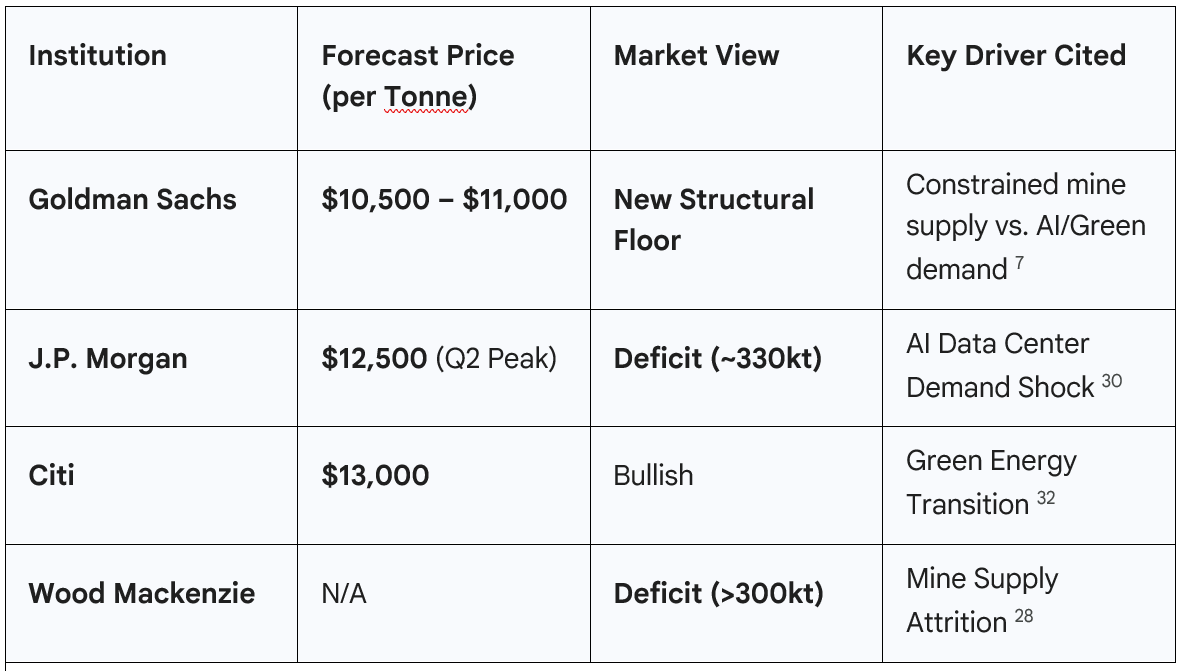

Price Forecasts and the "New Floor"

Financial institutions have responded to these structural deficits by revising their long-term price forecasts, suggesting a permanent repricing of copper.

Table 2: Institutional Copper Price Forecasts (2026)

The consensus is clear: copper is entering a period of scarcity pricing where the marginal buyer (AI hyperscalers) is price-insensitive, forcing traditional users to compete for limited units.

Platinum Group Metals: The Divergence of Platinum and Palladium

The Platinum Group Metals (PGMs) are experiencing a sharp bifurcation in their market outlooks. While Platinum (Pt) is entering a structural deficit driven by new energy technologies, Palladium (Pd) faces a long-term existential threat from electrification, mitigated only by the resilience of hybrid vehicles.

Platinum: Deep Deficits and the Hydrogen Catalyst

Platinum is currently in a state of acute undersupply. The World Platinum Investment Council (WPIC) identifies 2025 as the third consecutive year of significant deficits.

The Mathematics of Scarcity

2025 Deficit: The market is forecast to record a deficit of 692,000 ounces (692 koz) in 2025.

Stock Depletion: These deficits are being met by drawing down Above Ground Stocks (AGS). By the end of 2025, AGS will have been depleted by roughly 42% over three years, reducing global inventory to less than five months of demand cover. This rapid depletion removes the market's shock absorber.

The Hydrogen Future

Beyond 2026, the Hydrogen Economy becomes a material driver of platinum demand. Platinum is the primary catalyst in Proton Exchange Membrane (PEM) electrolyzers (used to create Green Hydrogen) and PEM fuel cells.

Demand Growth: Demand from the hydrogen sector is forecast to grow from a negligible ~40 koz in 2023 to 476,000 ounces by 2028.34 This demand is "new money," independent of the auto cycle, creating a diverse demand base.

The 2026 "False Balance"

WPIC forecasts a balanced market (small surplus of 20 koz) in 2026. However, deeper analysis reveals this is contingent on massive investment outflows (selling of bars/coins and ETF liquidation) totaling nearly 320 koz. If investors, sensing the hydrogen opportunity or sovereign debt risks, do not sell, the market would remain in a deep deficit of roughly 300 koz.

Palladium: The Hybrid Trap and Short Squeeze Risk

Palladium is heavily exposed to the internal combustion engine (ICE), with over 80% of demand coming from autocatalysts.

The Hybrid Lifeline

Contrary to aggressive EV adoption forecasts, the automotive market has seen a resurgence in Hybrid Electric Vehicles (HEVs). Hybrids require catalytic converters, often with higher PGM loadings than standard ICE vehicles due to the frequent start-stop cycling of the engine, which cools the catalyst and reduces its efficiency. This trend has supported palladium demand, preventing a price collapse.

The Short Squeeze Potential

Despite long-term headwinds from EVs, palladium is vulnerable to short-term spikes. The market has high short interest. Given that Russia (Nornickel) is a dominant supplier, any geopolitical disruption or sanctions tightening could trigger a "short squeeze," forcing prices rapidly higher toward $1,800–$4,000 as industrial users scramble for physical metal.

The Monetary Dimension: Revaluation and Liquidity

The analysis of industrial metals cannot be divorced from the broader monetary environment. The sheer expansion of global liquidity (M2) and sovereign debt levels has reignited the debate over the monetary role of gold and silver.

The US Treasury Gold Revaluation Hypothesis (S. 954)

A significant "tail risk" identified in the research is the legislative proposal to revalue U.S. gold reserves.

The Mechanism: The U.S. Treasury holds approximately 261.5 million ounces of gold, valued on its books at the statutory rate of $42.2222 per ounce (established in 1973). This values the reserves at a mere $11 billion.

The Proposal: Legislative bill S. 954 (introduced March 2025) proposes revaluing these gold certificates to market prices (e.g., ~$3,000 - $4,500/oz).

The Impact: Marking the gold to market would realize an accounting profit of nearly $900 billion. The proposal suggests using this windfall to fund a "Strategic Bitcoin Reserve" or to pay down debt.

Implications: While politically contentious, such a move would officially acknowledge the devaluation of the US Dollar since 1973. It would likely trigger a repricing of all hard assets, as the "shadow price" of gold becomes the official price.

M2 Money Supply and Metal Prices

Macro-strategists highlight the correlation between M2 Money Supply and metal prices. They argue that when adjusted for M2 growth, silver and gold are significantly below their 1980 or 2011 peaks. For example, the 1980 silver high of $50/oz would be equivalent to over $140/oz in 2025 dollars. Technical analysis of a 45-year "Cup and Handle" chart suggests a breakout for silver that could target triple digits, driven by monetary debasement rather than just industrial supply.

Equity and Capital Market Implications: First-Order Beneficiaries

The transition from “price discovery” to “availability discovery” in critical metals will not be captured solely in spot markets; it will be transmitted, often with leverage, through the capital structures of producers, refiners, and royalty companies. In a structurally tight environment, the operating and financial gearing embedded in these businesses transforms incremental price moves into nonlinear equity value creation.

Silver: High-Leverage Producers and Royalty Structures

Among silver-linked equities, the greatest first-order beneficiaries of a sustained repricing regime are:

Primary silver producers with low all-in sustaining costs (AISC): Companies operating at AISCs well below a rising spot curve exhibit powerful margin expansion, as fixed and semi-fixed cost bases intersect with parabolic revenue lines. At $75–$100/oz silver, a producer with AISC of $15–$20/oz can see unit margins expand several hundred percent, with free cash flow inflecting from cyclical to structurally high. This dynamic is magnified for assets in tier-one jurisdictions (Canada, U.S., Australia) where political risk premia compress valuation discounts and support higher enterprise value per ounce metrics.

Royalty and streaming companies: Royalty and streaming vehicles, which purchase a portion of future silver output in exchange for upfront capital, are uniquely positioned to benefit from scarcity pricing without direct exposure to rising operating or capital costs. Their quasi-fixed purchase prices create convexity to the upside: each dollar of silver price appreciation drops almost entirely to gross margin. In an era of escalating project CapEx and permitting friction, these models can attract premium valuations as “capital-light” ways to access the scarcity thesis.

Copper: Scarcity Rents and AI-Linked Infrastructure

If copper indeed migrates to a $10,000+/tonne structural floor, the beneficiaries will bifurcate between incumbent producers sitting on long-life, low-cost resources and integrated refiners able to capture refining spreads in a constrained concentrate market.

Long-life, low-cost producers: Miners with large, politically secure reserves and existing infrastructure (e.g., brownfield expansions rather than greenfield megaprojects) will effectively earn “scarcity rents” as incentive prices for new supply move well above their cost curves. For these assets, the AI and grid-buildout demand shock does not just raise near-term EBITDA; it extends reserve lives at higher realized prices, inflating net present values (NPVs) and justifying lower discount rates in institutional models.

Refiners and smelters with secure feedstock: The collapse of TC/RCs and subsequent smelter production cuts underscore that refining capacity, not just mine capacity, is a strategic choke point. Smelters that can secure long-term concentrate supply—via captive mines, JV structures, or off-take agreements—will be positioned to reclaim margin as refined premia widen in a structurally undersupplied market. In a regime where AI data centers alone are projected to account for a meaningful share of incremental copper demand by 2030, even modest tightening in refined markets can re-rate integrated operators as “infrastructure enablers” rather than mere toll processors.

Platinum Group Metals: Hydrogen-Linked Optionality

In the PGM complex, equity market implications mirror the fundamental divergence between platinum and palladium.

Platinum producers leveraged to hydrogen demand: As hydrogen-related platinum demand scales from tens of thousands of ounces to several hundred thousand ounces annually, producers with high exposure to platinum (relative to palladium) and manageable geopolitical risk profiles will effectively acquire a “hydrogen call option” embedded in their reserves. The prospect of hydrogen end markets accounting for a high-single to low-double-digit share of total platinum demand by 2030 supports higher long-term price decks and incentivizes capital allocation toward platinum-dominant ore bodies.

Palladium producers and by-product exposure: Palladium-centric producers remain structurally tethered to the internal combustion and hybrid vehicle cycle, implying decelerating terminal growth but elevated volatility. Equity valuations will likely oscillate between discounting eventual demand erosion and pricing in episodic short squeezes driven by geopolitical supply shocks or transient hybrid surges. In this context, diversified PGM producers with balanced Pt/Pd/Rh baskets may command relative valuation premiums as investors seek exposure to platinum’s hydrogen upside while mitigating palladium’s long-tail demand risk.

Capital Allocation, Jurisdiction, and the Cost of Scarcity

Across all three metal complexes, institutional capital is already discriminating between “resource optionality” and “scarcity delivery.” Projects located in stable jurisdictions with clear permitting pathways, existing infrastructure, and funded development plans are being capitalized at higher EV/resource multiples than geologically similar assets in high-risk regions. As metals transition from cyclical commodities to strategic inputs, equity markets are likely to reward:

Balance sheets capable of self-funding growth at higher price decks, avoiding dilutive issuance in the next capex cycle.

Management teams that pivot from volume-maximization to return-on-resource, treating in-situ ounces and tonnes as scarce financial assets rather than exhaustible inventory.

In this framework, producers, refiners, and royalty companies are not merely downstream recipients of higher spot prices; they become the primary conduits through which scarcity is financialized. Their equity and credit instruments will increasingly serve as leveraged expressions of a world where the marginal utility of a tonne of copper, an ounce of silver, or a gram of platinum exceeds the marginal utility of additional fiat liquidity.

Conclusion

The period from 2025 to 2030 will be defined by the end of commodity abundance. The industrial logic of "just-in-time" inventory is breaking down in the face of technological shifts that demand specific, scarce elements.

Silver faces a "Singularity" where solid-state battery demand creates a new, massive vertical just as solar demand becomes price-inelastic due to reliability constraints.

Copper is the non-negotiable substrate of the AI economy, with a price floor of $10,000/tonne established by the physical inability of mines to meet data center power density requirements.

Platinum offers a dual-thesis: a current deficit driven by supply failure, and a future option on the hydrogen economy.

Monetary Metals are being reconsidered as sovereign assets, with the US gold revaluation debate highlighting the fragility of fiat valuations.

Investors and industrial planners must recognize that securing physical access to these metals will likely be the defining challenge of the coming decade. The market is moving from "price discovery" to "availability discovery." For investors this means carefully studying the tactical and strategic imperative of allocating to silver in the immediate term, and to metals more broadly over the long term.

We would be honored to serve as a resource for your organization. Contact us today to discuss:

Contact | Connect with Financial Experts — Wind River Capital Strategies

Avery Ersztein

Sources & Works Cited

1. How much silver goes in a solid state battery? : r/Silverbugs - Reddit, accessed December 28, 2025, https://www.reddit.com/r/Silverbugs/comments/1pqtj8b/how_much_silver_goes_in_a_solid_state_battery/

2. Samsung's Solid-State Battery Could Be Silver's Next Big Demand ..., accessed December 28, 2025, https://www.indmoney.com/blog/us-stocks/samsung-solid-state-battery-silver-demand

3. Alleviating contaminant-induced degradation of TOPCon solar cells with copper plating, accessed December 28, 2025, https://www.researchgate.net/publication/389769782_Alleviating_contaminant-induced_degradation_of_TOPCon_solar_cells_with_copper_plating

4. Reducing TOPCon Solar Cell Degradation via Copper Plating: Key Findings from UNSW Research, accessed December 28, 2025, https://solarandsolar.hu/reducing-topcon-solar-cell-degradation-via-copper-plating-key-findings-from-unsw-research/

6. Dr. Copper’s Diagnosis: What the Red Metal’s Record Surge to $12,000 Tells Us About the Global Economy, accessed December 28, 2025, https://markets.financialcontent.com/wral/article/marketminute-2025-12-26-dr-coppers-diagnosis-what-the-red-metals-record-surge-to-12000-tells-us-about-the-global-economy

7. GS - Copper Critical and Supply Constrained $10000 Is The New Price Floor | PDF - Scribd, accessed December 28, 2025, https://www.scribd.com/document/933819169/20251006-GS-Copper-Critical-and-Supply-Constrained-10-000-is-the-New-Price-Floor

8. Goldman Sachs on copper prices: $10,000 has become the "new floor," with $11,000 as the upper limit over the next two years. - Moomoo, accessed December 28, 2025, https://www.moomoo.com/news/post/59375899/goldman-sachs-on-copper-prices-10000-has-become-the-new

9. What's Next for Platinum Investment? - CME Group, accessed December 28, 2025, https://www.cmegroup.com/articles/2025/whats-next-for-platinum-investment.html

10. Could Platinum Go Even Higher in 2026? - The Streetwise Reports, accessed December 28, 2025, https://www.streetwisereports.com/article/2025/12/26/could-platinum-go-even-higher-in-2026.html

11. Could Palladium Prices Return to the $4,000 Mark in 2026? - Bullion Exchanges, accessed December 28, 2025, https://bullionexchanges.com/blog/will-palladium-climb-back-toward-4000-in-2026

12. Metals Focus: Bullish on Platinum, Bearish on Palladium in 2026 - Nasdaq, accessed December 28, 2025, https://www.nasdaq.com/articles/metals-focus-bullish-platinum-bearish-palladium-2026

13. The Federal U.S. Gold Stock - Every CRS Report, accessed December 28, 2025, https://www.everycrsreport.com/files/2025-09-23_IF13109_9b6a4d00342e2e9d1e445e232d08b56d70ab0e36.pdf

14. Should US Treasury Revalue Gold Reserves - TradersPost Blog, accessed December 28, 2025, https://blog.traderspost.io/article/us-treasury-gold-revaluation-debate

15. Samsung SDI Ramps Up Fundraising for Battery Capacity Expansion How Will Silver Demand Fare for Super-Gap Solid-State Batteries? [SMM Analysis] - Shanghai Metal Market, accessed December 28, 2025, https://www.metal.com/en/newscontent/103237677

16. Samsung's Silver Solid State Battery Closer to Becoming Mainstream, accessed December 28, 2025, https://batteriesnews.com/samsungs-silver-solid-state-battery-closer-to-becoming-mainstream/

17. Samsung's Silver Solid State Battery Technology: 1 Kilogram of Silver per Car, accessed December 28, 2025, https://www.goldenstatemint.com/blog/samsungs-silver-solid-state-battery-technology-1-kilogram-of-silver-per-car/

18. Samsung's 600-Mile-Range Batteries That Charge in 9 Minutes Ready for Production/Sale Next Year - Good News Network, accessed December 28, 2025, https://www.goodnewsnetwork.org/samsungs-600-mile-range-batteries-that-charge-in-9-minutes-ready-for-production-sale-next-year/

19. Samsung SDI to Collaborate on All-Solid-State Battery Validation Project with BMW Group, accessed December 28, 2025, https://www.samsungsdi.com/sdi-now/sdi-news/4565.html

20. Samsung's 600-Mile-Range Solid State Batteries That Charge in 9 Minutes Ready for Production/Sale Next Year - Reddit, accessed December 28, 2025, https://www.reddit.com/r/electricvehicles/comments/1pudach/samsungs_600milerange_solid_state_batteries_that/

21. Harnessing the Sun: Silver's Critical Role in Solar Energy - Advent Research Materials, accessed December 28, 2025, https://www.advent-rm.com/en-GB/Articles/2025/01/Harnessing-the-Sun-Silver-s-Critical-Role-in-Solar

22. Silver Paste Consumption Declines, Growth in Silver Consumption for PV May Slow Down, accessed December 28, 2025, https://www.metal.com/en/newscontent/103545216

23. Solar Installations Surge, But Silver Thrifting Goes Into Overdrive, accessed December 28, 2025, https://www.goldenstatemint.com/blog/solar-installations-surge-but-silver-thrifting-goes-into-overdrive/

24. Out with the silver in with the copper A new boost for solar cells - Fraunhofer-Gesellschaft, accessed December 28, 2025, https://www.fraunhofer.de/en/press/research-news/2022/september-2022/out-with-the-silver-in-with-the-copper-a-new-boost-for-solar-cells.html

25. Copper plating helps reduce degradation in TOPCon cells, research shows - PV Tech, accessed December 28, 2025, https://www.pv-tech.org/copper-plating-helps-reduce-degradation-in-topcon-cells-research-shows/

26. Silver Squeeze 2025: The 45-Year Chart Pointing to Triple-Digit Prices, accessed December 28, 2025, https://goldsilver.com/industry-news/video/silver-squeeze-2025-the-45-year-chart-pointing-to-triple-digit-prices/

27. Rising Copper Demand: Powering AI and Clean Energy Revolution - Discovery Alert, accessed December 28, 2025, https://discoveryalert.com.au/ai-transforming-copper-demand-2025/

28. AI data-centre buildout pushes copper toward shortages, analysts ..., accessed December 28, 2025, https://www.tomshardware.com/tech-industry/ai-data-center-buildout-pushes-copper-toward-shortages-analysts-warn

29. Goldman Sachs Raises Copper Price Forecast to $9,890 for 2025 - Discovery Alert, accessed December 28, 2025, https://discoveryalert.com.au/goldman-sachs-copper-price-forecast-2025-2/

30. Copper Market Outlook | J.P. Morgan Global Research, accessed December 28, 2025, https://www.jpmorgan.com/insights/global-research/commodities/copper-outlook

31. Global Copper Supply Struggles While Demand from AI and Renewable Surges, accessed December 28, 2025, https://www.chemanalyst.com/NewsAndDeals/NewsDetails/global-copper-supply-struggles-while-demand-from-ai-and-renewable-40520

32. Copper Prices Soar to Record Highs Driven by Global Supply Constraints and Chinese Demand in 2025, accessed December 28, 2025, https://www.alm.com/press_release/alm-intelligence-updates-verdictsearch/?s-news-19695604-2025-12-08-copper-prices-record-highs-2025-global-supply-demand-china-impact

33. Platinum market to end 2025 with 692 koz deficit; potential easing of tariff fears leads to a more balanced platinum market in 2026 - PR Newswire, accessed December 28, 2025, https://www.prnewswire.com/news-releases/platinum-market-to-end-2025-with-692-koz-deficit-potential-easing-of-tariff-fears-leads-to-a-more-balanced-platinum-market-in-2026-302619223.html

34. World Platinum Investment Council: Policy Clarification Accelerates Hydrogen Electrolyzer Project Approvals, Supporting Platinum Investment Logic - Shanghai Metal Market, accessed December 28, 2025, https://www.metal.com/en/newscontent/103214220

35. Policy Clarification Accelerates Hydrogen Electrolyzer Project Approvals, Supporting Platinum Investment Logic | SMM - Metal News, accessed December 28, 2025, https://news.metal.com/newscontent/103214220/World-Platinum-Investment-Council:-Policy-Clarification-Accelerates-Hydrogen-Electrolyzer-Project-Approvals-Supporting-Platinum-Investment-Logic

36. WPIC Platinum Quarterly Q3 2025, accessed December 28, 2025, https://platinuminvestment.com/files/954835/WPIC_Platinum_Quarterly_Q3_2025.pdf

37. Historic Gold, Silver, Platinum, & Palladium Price Spikes | JM Bullion, accessed December 28, 2025, https://www.jmbullion.com/investing-guide/pricing-payments/historic-gold-silver-platinum-palladium-price-spikes/