The Quiet Storm in Fixed Income: A Fiduciary Playbook for Navigating Duration Risk

This report provides a comprehensive analysis of the current macroeconomic environment and its profound implications for public and private pension funds and endowments (E&Fs). It posits that the multi-year rise in interest rates has created a "quiet storm" of duration risk in long-dated fixed-income portfolios, a risk that has remained largely unrealized but is nonetheless a critical threat to long-term solvency. By deconstructing the macroeconomic landscape, learning from the cautionary tales of the 2023 bank failures, and applying a robust, liability-driven investment (LDI) framework, this report offers CIOs a strategic playbook for mitigating this risk and positioning their portfolios for resilience and long-term success.

Inflationary Dynamics: The Fed's Dual Mandate in Flux & The Shifting Terrain for Institutional Capital

The trajectory of inflation is a central determinant of monetary policy and, by extension, the performance of fixed-income assets. The latest data from the Bureau of Economic Analysis and the Bureau of Labor Statistics provides a nuanced picture of price pressures. As of July 2025, the all-items Consumer Price Index (CPI) increased by 2.7 percent over the last 12 months, while the core CPI, which excludes volatile food and energy components, rose by 3.1 percent over the same period. The Federal Reserve's preferred inflation gauge, the core Personal Consumption Expenditures (PCE) Price Index, was up 2.9 percent year-over-year in July 2025. While these figures show a clear moderation from prior periods, they remain above the Fed's stated long-term 2 percent target, indicating that the fight against inflation is not yet over.

A closer look at the data reveals a complex and contrasting set of price pressures. The energy index, for instance, has decreased by 1.6 percent over the past year, with gasoline prices falling 9.5 percent. This cooling effect on commodities has been a key factor in bringing down the headline inflation rate. However, this is largely being offset by persistent and elevated price growth in the services sector. The shelter index, a significant component of the CPI, increased by 3.7 percent over the last year, with owners' equivalent rent and rent both rising by 0.3 percent in July alone. Additionally, consumer spending and personal income continue to show resilience, rising 0.5 percent and 0.4 percent respectively in July, a sign of continued robust household demand despite higher prices.

The underlying dynamics of inflation suggest that the narrative of "higher for longer" for long-term bond yields is not solely a function of Federal Reserve policy. The institutional analysis indicates that geopolitical fragmentation, rising government debt and deficits, and significant capital expenditures on initiatives like the AI buildout and the low-carbon transition are all contributing to macroeconomic pressures. This means that even if the Fed follows through with its anticipated rate cuts, long-term yields may not fall commensurately, as investors will continue to demand higher compensation for risk. For fiduciaries, this presents a significant challenge: the expected relief for long-duration fixed-income portfolios from a Fed easing cycle may be incomplete, forcing a reevaluation of the role these assets play as portfolio ballast.

The Labor Market's Slowdown: A Cracking Foundation

The U.S. labor market, long a pillar of economic resilience, is now showing clear signs of deterioration. The August 2025 jobs report was a critical inflection point, with non-farm payrolls adding a mere 22,000 jobs, far below expectations and a continuation of a slowdown that began in April. This was compounded by significant downward revisions to prior months, including a loss of 13,000 jobs in June, marking the first negative reading since late 2020. The unemployment rate ticked up to 4.3 percent, its highest level since late 2021, while average hourly earnings cooled to a 3.7 percent annual growth rate. The number of long-term unemployed, defined as those jobless for 27 weeks or more, climbed to 1.93 million, the highest level since late 2021.

This weakening in the labor market provides a direct and powerful impetus for the Fed to pivot to a rate-cutting cycle. For years, the Fed's dual mandate of price stability and maximum employment allowed it to prioritize inflation control while the job market remained strong. The rapid deterioration of employment conditions, however, now makes the employment mandate a more pressing concern than persistent but moderating inflation. Institutional analysis from UBS suggests that "downside risks to employment are likely to outweigh lingering inflation concerns" in the Fed's decision-making. This shift in focus is a major inflection point in monetary policy. The market is now pricing in a near-certain rate cut in September, a sentiment described by one institutional source as a "forgone conclusion". For fiduciaries, this means that the short end of the yield curve is likely to experience capital appreciation, while the long end remains burdened by the aforementioned structural factors. This dynamic reinforces the strategic importance of actively managing duration within fixed-income portfolios rather than simply holding a passive, long-dated position.

Monetary Policy at a Crossroads: The Data-Dependent Pivot

The cumulative effect of the Federal Reserve's rate hikes, which totaled 450 basis points from March 2022 to early 2023, has had a clear effect on the economy. The consensus institutional view is that the Fed will resume its easing cycle, with some forecasts predicting as many as 100 basis points of cuts over the next four meetings. Market expectations, as of September 2025, are for a rate cut at the next Federal Open Market Committee (FOMC) meeting. The Fed's commitment to being "data dependent" means this path is contingent on continued softening of inflation and labor market data.

While short-term rates are poised to fall, the outlook for the long end of the yield curve is more complex. Institutional insights suggest that long-term Treasury yields will likely remain "higher for longer" as global investors demand higher compensation for risk due to rising debt, deficits, and geopolitical fragmentation. This creates a potentially steepening yield curve, where the gap between short- and long-term yields widens. This is a critical distinction for fiduciary investors. A fall in short-term rates, while beneficial to the economy and short-duration assets, will not necessarily translate to a significant capital appreciation in long-duration portfolios if the long end remains elevated. The structural pressures on the long end of the curve will persist regardless of the Fed's short-term easing policy.

The Quiet Storm in Fixed Income: Duration Risk as a Systemic Threat

Now lets define and contextualize the primary risk at the heart of the fiduciary challenge: bond duration. We will use the 2023 bank failures as a powerful, albeit distinct, cautionary tale for fiduciaries.

Deconstructing Duration: The Mechanics of Interest Rate Sensitivity

Duration is a critical measurement of a bond's interest rate risk that considers its maturity, yield, coupon, and any call features. It provides a singular, powerful number that measures how sensitive a bond's value is to changes in interest rates. A fundamental principle of bond investing is the inverse relationship between interest rates and bond prices. When market interest rates rise, newly issued bonds offer higher yields, making existing lower-yielding bonds less attractive and forcing their prices down. This effect is most pronounced for bonds with longer maturities and lower coupon rates.

The "quiet storm" for fiduciaries is the tangible, and in many cases, massive, unrealized loss on the balance sheets of institutions holding long-duration fixed income. While a portfolio of long-dated bonds has traditionally been viewed as a "safe" or "risk-free" asset class due to its high credit quality, this assumption holds only if the bonds are held to maturity. The aggressive rate hikes of the past few years, which caused the yield on long-dated debt to jump significantly, led to a commensurate plunge in market value. For example, a 2 percentage point rise in a 30-year bond's yield can cause its value to fall by around 32 percent. The principal of the bond is not lost if held to maturity, but the market value is significantly lower, representing a significant mark-to-market loss. The "quiet storm" becomes a "realized loss" when an institution is forced to sell these assets prematurely to meet liquidity needs.

The Fiduciary Cautionary Tale: Lessons from the 2023 Bank Failures

The collapses of Silicon Valley Bank (SVB) and First Republic were textbook cases of a catastrophic duration mismatch between assets and liabilities. SVB had over 55 percent of its assets invested in long-duration fixed-income securities, with approximately 56 percent of the portfolio having a repricing period of more than 15 years. In stark contrast, its liabilities were concentrated in short-term, uninsured deposits that were highly susceptible to a bank run.

When depositors began withdrawing funds, SVB was forced into a desperate and catastrophic position: it had to sell its long-duration securities into a plummeting market to meet its liquidity needs. This converted a massive unrealized mark-to-market loss of over $15 billion on its held-to-maturity (HTM) portfolio into a realized loss, which essentially wiped out the bank's equity base and triggered a bank run. While CIOs of E&Fs do not face the same kind of short-term, uninsured depositor runs, they share the same fundamental vulnerability. The core lesson is not about depositor panic but about the structural fragility of a balance sheet with significant, sometimes hidden unrealized losses.

For E&Fs, liabilities are not demand deposits but long-term obligations to pensioners and institutional operating budgets. However, these liabilities still have cash flow requirements: pension payments, financial aid commitments, and operating expenses. As endowments have experienced, higher operating costs driven by inflation can lead to increased reliance on endowment distributions. If this trend continues, it could force institutions to liquidate portions of their asset base to meet these growing cash flow needs, potentially at a time of market stress. The SVB failure is a stark reminder that even high-quality assets like U.S. government bonds become illiquid and susceptible to significant capital loss when they must be sold prematurely. For fiduciaries, the risk is not insolvency from a depositor run but the erosion of principal and a negative feedback loop that harms long-term sustainability.

Table 1: Duration's Price Sensitivity

This table provides a simple, quantitative illustration of the relationship between duration, interest rate changes, and price impact. The data shows how the same 300-basis point change in rates can have a dramatically different effect on bond prices depending on their duration.

Strategic Implications for Pension and Endowment CIOs

Now we can synthesize the macroeconomic trends and the threat of duration risk into a set of tangible strategic implications for institutional fiduciaries.

The Paradox of Safety: Why Long-Term Bonds Are Not Risk-Free

The erosion of purchasing power is a constant threat to fiduciaries. Inflation, even at a moderating rate, diminishes the real value of a bond's future cash flows. For example, a 2023 study on endowments revealed that while market values grew, higher costs outpaced revenue, resulting in narrower operating margins and increased reliance on endowment distributions. This dynamic highlights the need for investment returns that not only preserve but grow capital in real terms.

The traditional role of fixed income as a "risk-averse" asset class has been challenged in the recent environment. In a period of rising interest rates, bonds can be a source of capital loss, and the historic low or negative correlation with equities can break down. During the 24-month period from 2022 to 2023, the correlation between stocks and bonds rose to 0.6, meaning they moved in tandem, a significant deviation from the long-term average near zero. This occurred as both asset classes responded to the same inflationary and monetary policy shocks: rising inflation prompted the Fed to hike rates, which hurt bond prices and increased the cost of capital for corporations, which in turn hurt stock prices. Fiduciaries who relied on a traditional 60/40 allocation for diversification were exposed to greater-than-expected risk during this period, demonstrating that the foundation of their strategic asset allocation was temporarily compromised. This necessitates a more dynamic and diversified approach to fixed income that looks beyond traditional government debt.

The Growing Pressure on Liabilities and Spending

The effect of rising rates is not uniform across all institutional investors. A 2023 Endowment Radar Study revealed that higher costs and effective spending rates were the major story, with the median endowment dependence on distributions growing to 16.3 percent. This was driven by a 10.5 percent increase in endowment distributions to support institutional operating budgets. The increasing cost of doing business puts pressure on the endowment to distribute more capital, which can lead to the liquidation of assets at an inopportune time if investment returns are insufficient.

In contrast to endowments facing higher operating costs, public pension plans may benefit from a sustained period of higher interest rates. The higher rates increase the expected investment returns for the plans, making their liabilities less expensive and reducing the pressure to take on excessive investment risk. A higher assumed rate of return allows a pension plan to increase its discount rate, which in turn lowers the present value of its future liabilities. While this provides some welcome relief, most plans are taking a cautious approach, waiting to ensure that the change in return expectations is not temporary before making any adjustments to their discount rates. This divergence of interests requires tailored strategic solutions. While a "higher for longer" environment may alleviate pressure on pension plans, it compounds the challenges for endowments, making active risk management and diversification paramount for the latter.

A Rigorous Framework for Risk Mitigation and Strategic Allocation

Now we can move from analysis to actionable recommendations, providing CIOs with a strategic playbook grounded in academic research and modern portfolio theory, adapted for the unique context of institutional investors.

Reorienting the Risk Mindset: From Variance to Solvency

The limitations of traditional Modern Portfolio Theory (MPT) are well-documented. As a single-period, assets-only model, it equates risk with short-term volatility (variance) and does not explicitly account for cash flows, longevity risk, or the ability to meet long-term financial goals. An MPT-optimized portfolio may have a low standard deviation but could still fail to generate enough return to meet spending goals, leading to a financial plan failure. This is the core of "sequence risk" and represents the true "nightmare scenario" for a fiduciary.

For fiduciaries, a more holistic approach is required. Liability-Driven Investment (LDI) and Asset-Liability Management (ALM) are frameworks that explicitly link the assets and liabilities of an organization. The goal is not to maximize returns against a market benchmark but to ensure that cash flow from assets is sufficient to meet future obligations. This approach prioritizes a "success probability target" (e.g., a 90% chance of meeting all future obligations) over a market-index benchmark. A CIO's primary mandate should be to ensure the long-term solvency and sustainability of the institution. LDI and ALM provide the conceptual and mathematical framework to do just that, using institutional-grade economic models and scenario generators to model future outcomes.

Implementing the LDI Playbook: Tools for a Higher Rate World

The central strategy of LDI is duration matching; aligning the duration of the asset portfolio with the duration of the liabilities. This helps to mitigate the impact of interest rate changes on the portfolio's value relative to its liabilities. While physical bonds can be used for duration matching, the use of derivatives has become central to modern LDI. Interest rate swaps, for example, are a primary tool for hedging duration risk. A pension fund can use swaps to exchange a fixed-rate stream for a floating-rate stream, allowing it to hedge against rising interest rates without having to sell off physical bond holdings. This is particularly useful for closing a duration gap when a fund has insufficient capital to buy a large number of physical long bonds. Similarly, longevity swaps can be used by pension funds to hedge against longevity shocks that can unexpectedly alter the duration of liabilities, freeing up risk budget to be deployed into more rewarding asset classes.

Despite the compelling theoretical benefits, the actual adoption of derivatives for duration hedging by U.S. public pension funds is dramatically low and often inconsistent with their hedging needs. The data reveals a significant gap between academic theory and practical implementation, a finding that points to critical governance and operational challenges. This is likely due to the complexity of derivatives, a lack of transparency in disclosures, and the liquidity requirements for collateral. The use of leveraged LDI, for example, requires maintaining a sufficient collateral buffer capable of withstanding at least a 250 basis points adverse market movement to avoid a forced liquidation of core assets.\ The low adoption of these tools reveals a critical strategic and governance challenge for many fiduciaries who may be aware of the duration risk but are either unwilling or unable to implement the most efficient, capital-light hedging strategies.

Table 2: LDI Strategies & Risk Mitigation

This table serves as a quick-reference guide for CIOs, matching LDI techniques to the specific risks they are designed to mitigate.

Modernizing Fixed Income Allocation

A strategic pivot away from a simple, long-duration U.S. government bond portfolio is necessary. The current environment presents a unique opportunity to build a more resilient and higher-yielding fixed-income allocation by broadening the universe of credit and duration exposures. With the Fed poised to cut short-term rates, the short and intermediate ends of the yield curve are a compelling place to invest. Investors can lock in yields that are "above inflation and measurably higher than what we've experienced from 2009 through mid-2022". This allows a CIO to earn a strong return while minimizing long-duration risk.

Beyond traditional Treasuries, fiduciaries can diversify for resilience. High-quality corporate bonds offer higher yields than Treasuries for a small increase in credit risk. Municipal bonds offer compelling tax-equivalent yields and are fundamentally sound, with strong tax collections and robust revenue growth. A more dynamic mix of short-duration, high-quality corporate, and municipal bonds can re-establish the "ballast" function of a fixed-income portfolio by moving capital out of long-duration, principal-at-risk assets and into a mix of higher-yielding, more resilient exposures. This provides both capital preservation and a compelling income stream, which can fund growing institutional costs.

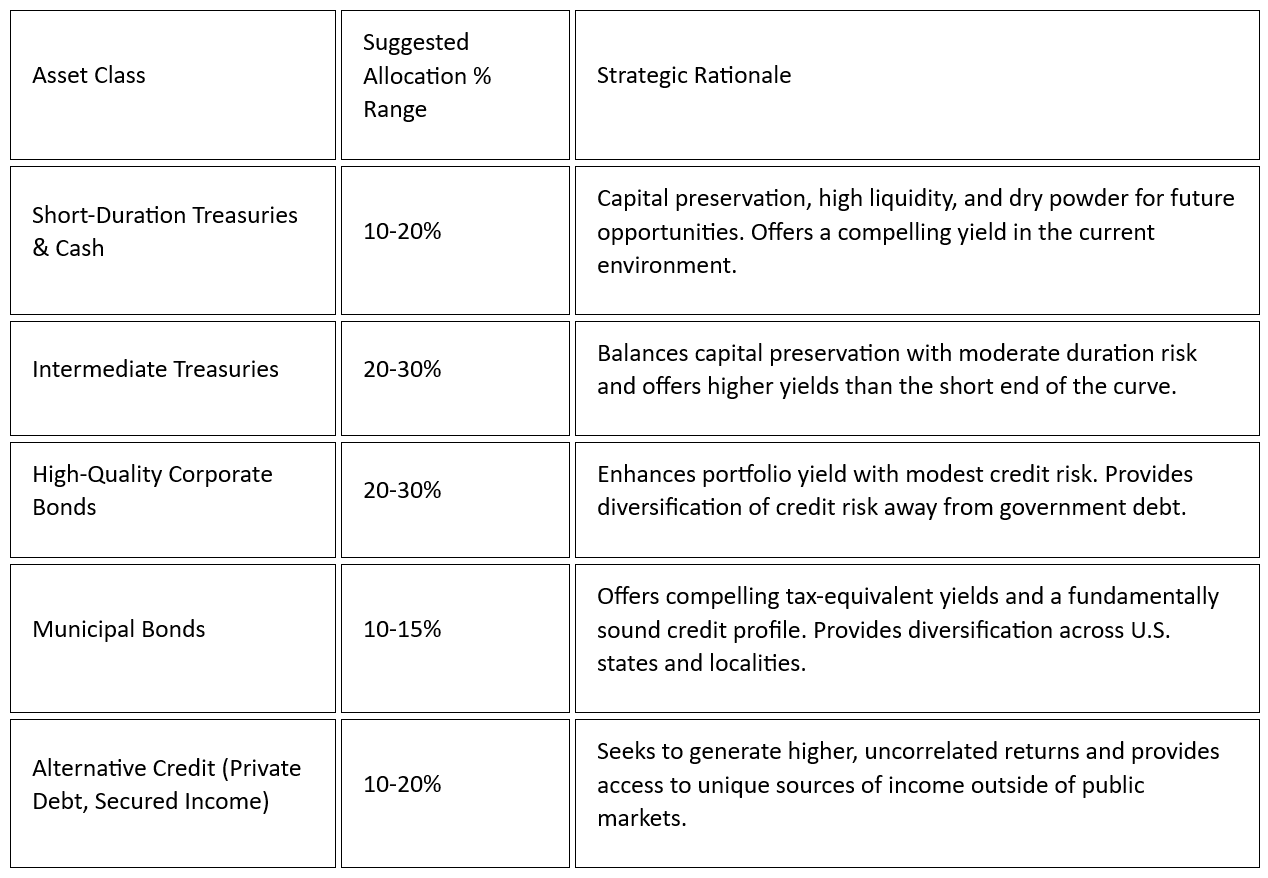

Table 3: Fixed Income Strategic Allocation Recommendations

This table provides a model strategic asset allocation for the fixed-income portion of an E&F portfolio, with clear rationales for each component.

Key Takeaways and Actionable Recommendations

he Fiduciary Mandate Reimagined

The current macroeconomic environment, defined by moderating inflation, a weakening labor market, and a Fed poised to cut rates, has exposed a critical vulnerability in traditional institutional portfolio construction. The "quiet storm" of duration risk, while not yet fully realized on many balance sheets, represents a profound threat to long-term solvency. The lessons from the 2023 bank failures serve as a cautionary tale: a duration mismatch between assets and liabilities, when met with a need for liquidity, can convert unrealized losses into a catastrophic erosion of principal. The fiduciary mandate must be re-conceived to prioritize solvency, capital preservation, and a holistic, liability-driven approach over a simple pursuit of benchmark-beating returns. The current environment is a test of governance and operational acumen as much as it is a test of investment strategy.

Prioritized Strategic Checklist for E&F CIOs

Based on the analysis, a prioritized strategic checklist for E&F CIOs is provided below, designed to guide immediate action and long-term planning.

Conduct a Full Asset-Liability Management (ALM) Review: The first and most critical step is to move beyond an asset-only review. Model the duration of both the assets and the liabilities, and stress-test the portfolio's ability to meet cash flow needs under various interest rate and inflation scenarios. This is the foundation of any sound, long-term strategy.

Quantify Duration Risk: Do not assume that long-duration holdings are risk-free. Conduct a thorough analysis to calculate the total unrealized loss in the portfolio and present this figure to the investment committee. This brings the "quiet storm" to the forefront of the conversation and provides a powerful impetus for change.

Diversify Fixed Income: Re-examine the fixed-income allocation with a focus on risk and return. Reduce exposure to long-duration government bonds and actively reallocate capital into a more dynamic mix of short and intermediate-duration Treasuries, high-quality corporate bonds, and compelling municipal offerings. This provides a more resilient and higher-yielding portfolio.

Evaluate Hedging Strategies: Importantly, and we cannot underscore this enough - explore the use of derivatives such as interest rate swaps to hedge duration risk and reduce capital-intensive physical bond holdings. This is a crucial step to address the duration mismatch without requiring massive capital outlays. Be prepared to lead the charge on governance and educate the board and committee on the mechanics and necessity of these tools.

Establish a Liquidity Buffer: If using derivatives or leveraged LDI, ensure a robust collateral buffer is in place, capable of withstanding at least a 250 basis points adverse market movement. This buffer is essential to avoid a forced liquidation of core assets in times of market stress.

Embrace Goals-Based Investing: Frame the portfolio strategy around the institution's financial goals and liabilities, not market benchmarks. Use a "success probability target" to guide asset allocation and decision-making, ensuring that the primary focus remains on the long-term sustainability of the institution.

We would be honored to serve as your resource in tackling the complex analysis and work recommended in this report.

Contact | Connect with Financial Experts — Wind River Capital Strategies