A Golden Age for Portfolio Insurance: The Strategic Case for Gold in the Endowment & Foundation Portfolio

A Golden Age for Portfolio Insurance: The Strategic Case for Gold in the Endowment & Foundation Portfolio

The Strategic Mandate for Gold

We stand at an inflection point in the global monetary architecture. The comfortable certainties of the post-Bretton Woods era, anchored by unquestioned faith in US Treasury securities as the ultimate risk-free asset, are giving way to a more fragmented, multipolar financial order. The modern institutional portfolio, most notably exemplified by the traditional 60/40 allocation, faces a new and complex set of systemic vulnerabilities. The foundational premise of this portfolio construction, that equities and bonds maintain a negative correlation and provide a natural hedge for one another, has been challenged in the last decade by the failure of long-term U.S. bonds to protect against equity downside. We posit that this breakdown is not a mere cyclical anomaly; it is a symptom of a new paradigm of portfolio risk. In this environment, where conventional assets can correlate to 1 and thereby fail to dampen portfolio volatility as intended, a re-evaluation of long-run strategic allocations is not merely prudent, but essential.

This report puts forth an unambiguous and analytically rigorous case for gold as a critical, long-term hedge uniquely suited to this new environment. Gold's value is not derived from its utility as a consumed commodity but from its unique role as a "neutral collateral" and a non-sovereign store of value in a world of increasing geopolitical and fiscal uncertainty. A deep analysis of market dynamics, supported by a novel analysis model, reveals that gold is no longer a peripheral or opportunistic asset but an essential piece of long-term portfolio insurance.

The central thesis in the composite analysis is buttressed by three key, data-backed drivers:

Structural Conviction Demand: The market is witnessing an unprecedented, secular shift in gold accumulation, primarily driven by central banks. This trend is not a fleeting reaction to market conditions but a fundamental, multi-year re-evaluation of reserve assets in response to the precedent set by geopolitical events.

Geopolitical and Fiscal Erosion: A rising tide of risks to U.S. institutional credibility, fiscal sustainability, and the long-term status of the U.S. Dollar as the world's primary reserve currency provides a powerful and enduring catalyst for a broader-based rotation into gold.

Demonstrated Hedging Power: Gold has a proven historical track record of delivering positive real returns precisely during those critical periods when both stocks and bonds have failed to do so simultaneously.

As a result of the triangulated data reviewed for this analysis we arrive at a conviction view. We recommend a higher-than-usual, positive allocation to gold in long-term institutional portfolios. This allocation should be considered a strategic position; a core component of a diversified portfolio, designed to fortify capital against the tail risks that traditional assets are increasingly unable to manage.

The New Frontier of Portfolio Risk: The Case for a Credibility Hedge

The Great Diversification Breakdown

The foundation of modern institutional portfolio theory rests on the principle of diversification. For decades, the negative correlation between equities and bonds, particularly U.S. Treasury bonds, has served as the primary mechanism for mitigating portfolio risk. The long-term U.S. bond market has historically provided a crucial hedge, appreciating in value during periods of economic downturn and equity market weakness. However, recent market events have challenged this core assumption, exposing a critical vulnerability in this traditional portfolio structure.

A heterogeneous analysis of recent market movements reveals a concerning pattern where long-term U.S. bonds have failed to provide the expected protection against equity downside. One notable instance occurred when long-term U.S. borrowing costs jumped in response to escalating concerns over fiscal sustainability, even as equities were selling off. This simultaneous sell-off in both asset classes is not the only recent example, and acts a material challenge to the core principle of the 60/40 portfolio and is not merely a transient market anomaly. Instead, we believe it represents a structural shift in the nature of portfolio risk.

The historical data underscores this point. Periods when both U.S. stocks and bonds have experienced negative real returns simultaneously are not random occurrences; they typically arise from inflation shocks, according to a Goldman Sachs analysis. In it, Goldman distinguishes between two types of these shocks: those originating from negative commodity supply shocks (against which assets like oil have historically hedged) and those stemming from a more profound erosion of institutional credibility. A loss of confidence in a central bank's ability to maintain price stability or a government's commitment to fiscal discipline can trigger a sell-off in bonds (due to inflation and sovereign risk) and equities (due to slow growth and policy uncertainty), causing their correlation to turn positive and eliminating the very diversification benefit the portfolio was built upon. This structural vulnerability elevates the discussion beyond simple market volatility and introduces the need for a hedge specifically designed to address a loss of U.S. sovereign institutional and fiscal credibility.

Gold's Unique Role in Tail-Risk Protection

Given the demonstrated vulnerability of the traditional portfolio in the composite data, the need for a complementary asset that provides true, non-correlated diversification is paramount. Gold's historical performance demonstrates its unique ability to serve as a portfolio ballast, particularly during periods of extreme duress. The analysis done by Goldman shows that during any 12-month period when both stocks and bonds had negative real returns, a rare but critical occurrence, either gold or oil provided positive real returns. This in our view, is gold’s most valuable contribution to an institutional portfolio: its capacity to provide a positive real return precisely when the primary engines of a portfolio are failing simultaneously.

Historical examples reviewed in our research provide powerful evidence of this function. In the 1970s, as runaway inflation and Fed subordination caused simultaneous negative real returns in both equities and bonds, gold prices surged. Gold also provided this critical hedge during the demand-driven recessions of 2001 and the 2008-2009 Global Financial Crisis, when the 60/40 portfolio faltered. This is further substantiated in a J.P. Morgan analysis which highlights that in 2022, a year in which global equity markets lost nearly 19% and global bonds lost 16%, gold delivered a positive 3% return, perfectly illustrating its role as a portfolio ballast and effective diversifier. Additional perspective from Fidelity and Merrill Lynch also supports gold's value in this context, noting its low correlation to traditional assets and its ability to act as a hedge against geopolitical turmoil and inflationary pressures, both of which are rearing their heads today.

For the institutional CIO, this shifts gold from a mere commodity tilt to a fundamental component of a long-term risk management strategy. Its value lies not in outperforming during bull markets, but in preserving capital and mitigating losses during the tail events that are becoming more frequent in the current macro-geopolitical climate.

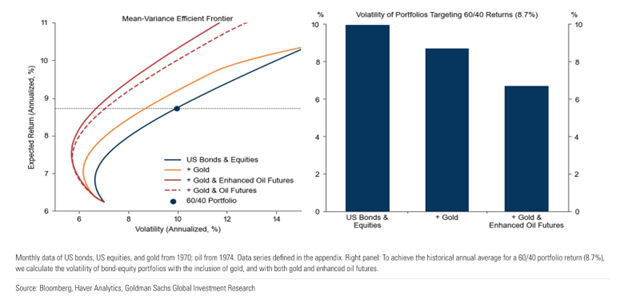

The value of this unique hedging power can be quantified through portfolio optimization analysis. The composite data demonstrates that the inclusion of gold in a traditional 60/40 portfolio has historically steepened the efficient frontier, offering a better risk-return tradeoff.

Quantifying the Value-Add of Gold to a 60/40 Portfolio

Sometimes a picture truly is worth a thousand words. The following illustration taken from the Goldman Sachs analysis shows how the addition of gold enhance the risk-adjusted return and reduce tail-risk exposure for a portfolio targeting the historical 8.7% average annual return of a 60/40 portfolio.

The Gold Market: Not a Commodity, But a Currency of Conviction

The "Gold is Different" Paradigm

To truly understand gold's strategic importance, it is necessary to fundamentally reframe how its market operates. Gold is an asset unlike any other commodity; to quote the Goldman analysis, “it is not consumed but rather accumulated and stored”. A staggering 220,000 tonnes of gold are estimated to exist above ground, and annual mine production adds a mere 1% to this existing stock. The slow, inelastic nature of mine supply is a structural reality of the industry, with output being planned years in advance and mining becoming more labor, energy, and capital-intensive with each passing year.

This profound difference is precisely why traditional supply-and-demand models, which are effective for forecasting markets like oil, entirely inadequate for gold. In a conventional commodity, high prices would eventually curb demand and stimulate supply, a dynamic often described as high prices cure high prices. Gold breaks this rule. The price of gold does not clear the market by balancing production with consumption; rather, it reflects a struggle over ownership. The market clears through a change of hands, with the price being a function of who is more willing to hold gold and who is willing to part with it. This shifts the focus of analysis entirely away from traditional commodity fundamentals and toward the dynamics of ownership flows.

The implication is that a sustained price rally in gold cannot be "cured" by an increase in supply. A small, persistent increase in demand from a powerful cohort of buyers can therefore have an outsized and self-reinforcing effect on the price. This fundamental paradigm is what gives gold its status as a store of value, and it is the key to understanding the current and future trajectory of the gold market.

The Conviction-Flow Model: The True Driver of Price Direction

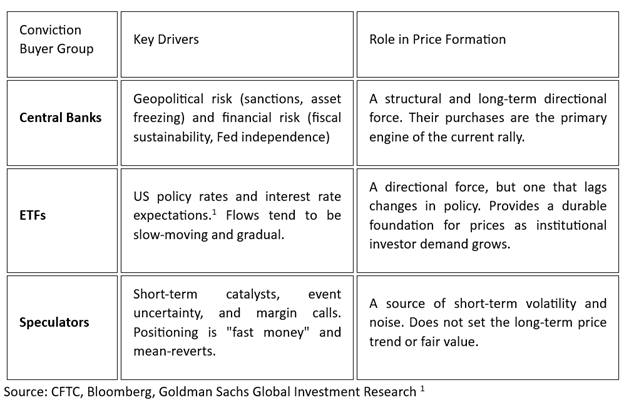

To properly analyze the gold market, it is essential to focus on the key players who drive changes in ownership. This is the central premise of the conviction-flow model introduced by Goldman Sachs. According to the model, the market is composed of two distinct groups of buyers: conviction buyers and opportunistic buyers.

Conviction Buyers: This group includes central banks, institutional investors (through ETFs), and speculators. They are the directional force in the market because their purchasing decisions are not driven by price but by a macro or risk-hedging thesis. When they decide to buy, they have the balance sheets and conviction to acquire gold irrespective of the current price level.

Opportunistic Buyers: This group consists primarily of price-sensitive households in emerging markets like China and India. Their role is secondary; they provide a crucial floor under prices by stepping in during price dips, but they rarely drive the overall trend or sell in a net sense.

The conviction-flow model finds that these thesis-driven flows explain a remarkable 70% of monthly gold price movements. The model provides a clear rule of thumb: a net purchase of 100 tonnes by conviction holders corresponds to a 1.7% rise in the gold price. This powerful relationship is a direct consequence of the ownership-driven nature of the market, where a sustained increase in demand from a large, price-insensitive group can force a reallocation of gold from opportunistic to conviction holders, driving the price higher in the process.

The analysis confirms a self-reinforcing dynamic. When conviction buyers enter the market, the price increases. This price increase, in turn, reduces demand from price-sensitive opportunistic buyers. The consequence is a re-allocation of demand, with a larger share of the above-ground gold stock being transferred to the conviction crowd. This feedback loop can lead to a disproportionately large price movement even from a relatively small but persistent increase in conviction flows. This is the core mechanism at play in the current market, and it is precisely why recent price movements are considered durable.

Table: The Conviction-Flow Model: Drivers and Price Impact

This table details the three primary "conviction buckets," their key drivers, and their role in shaping gold price direction, according to the Goldman Sachs conviction-flow model.

The Structural Case for Gold: A Confluence of Megatrends

The current gold rally is not an isolated event but a manifestation of powerful, long-term structural trends reshaping the global financial and geopolitical landscape. These forces, referred to as the "3D" drivers - De-risking, Defense, and Dollar diversification - are creating a new paradigm for commodities, with gold at the epicenter. While defense spending and energy de-risking primarily impact industrial metals, the third and most critical driver for gold is a fundamental shift in the global financial architecture.

The Unprecedented Central Bank Buying Spree

The most significant and unambiguous driver of the recent gold rally has been the unprecedented accumulation of gold by central banks, a trend that has surged fivefold since 2022. This is a historical shift that provides a powerful, long-term foundation for the gold price. The data shows that this trend is not a fleeting reaction but a structural re-evaluation of reserve assets in response to a major geopolitical event: the freezing of Russian central bank assets in 2022. This action set a powerful precedent, fundamentally altering how reserve managers think about asset safety and sovereignty.

Emerging market central banks, in particular, are seeking to insulate themselves from geopolitical sanction risk by diversifying into gold, the only reserve asset that cannot be frozen if held domestically. The evidence of this is widespread, with a World Gold Council survey indicating that a remarkable 95% of central banks expect global gold holdings to increase in the next 12 months, with none anticipating a decrease. Furthermore, 43% of central banks plan to increase their own holdings, the highest percentage since the survey began. This trend is expected to persist for at least another three years as central banks seek to reach their new, higher target reserve levels. This structural accumulation provides a powerful, multi-year tailwind for gold prices that is impervious to short-term market noise and rate policy.

Fiscal Expansion and the Erosion of Credibility

Beyond the geopolitical drivers, gold's strategic case is fortified by domestic fiscal and monetary risks. The rising U.S. debt-to-GDP ratio and mounting concerns over fiscal sustainability, combined with heightened political pressure on the Federal Reserve, are creating an environment ripe for institutional credibility shocks. Such a scenario, where Fed independence is perceived to be damaged, would likely lead to higher inflation, a sell-off in both stocks and long-dated bonds, and a potential erosion of the Dollar's reserve currency status (a concerning development already underway to some degree, in our view).

This leads to the most compelling upside scenario for gold: a broader, private investor diversification out of dollar-denominated assets. The gold market is exceptionally small relative to other major asset classes. Global gold ETF holdings represent only about 1% of outstanding U.S. Treasuries and 0.5% of the S&P 500 market capitalization. This asymmetry presents a powerful case for outsized price appreciation. The analysis estimates that if even a small fraction, for example, 1% of the privately-owned U.S. Treasury market were to flow into gold (flight to quality), it could cause a material price spike, potentially pushing gold to nearly $5,000 per troy ounce, a level significantly above even bullish baseline forecasts. This dynamic demonstrates a powerful feedback loop, where central bank buying serves as a leading indicator for what could be a much larger rotation by private investors, positioning gold for its next leg up.

The "3D" Drivers of Structural Commodity Tightening

This table outlines the structural megatrends identified in the research, their primary impacts, and the specific relevance of each to the strategic case for gold.

Strategic Allocation & Actionable Insights for the CIO

The Unambiguous View: Overweight Gold

Based on comprehensive analysis of the data sourced from a broad evidentiary base, we reiterate what has been our long-held (since 2022) conviction view; the strategic case for gold in an institutional portfolio is clear and compelling. Gold has not (for at least two years) been and is unambiguously no longer a tactical trade but a core, long-term strategic allocation. As a result, we recommend a higher-than-usual allocation to gold, particularly in long-term portfolios with a horizon of 5 years or longer. This allocation is to protect against shocks to institutional credibility and to capitalize on sustained central bank demand.

This view is not an outlier but a consensus that has emerged among high-quality investment firms, fully two years after our own conviction stance was shared with clients. The recent commentary from Citi, J.P. Morgan, and UBS is now uniformly bullish on gold's long-term prospects, citing the same structural drivers: persistent inflation fears, geopolitical tensions, and ongoing central bank accumulation. J.P. Morgan and other firms project gold prices to average at or approach $4,000 per troy ounce in 2026, while Goldman Sachs maintains a firm mid-2026 forecast of $4,000 per troy ounce as its baseline. This confluence of opinion from a range of additional high integrity sources provides a powerful signal that the market is recalibrating its perception of gold's value, moving it to a much higher price plateau than in previous cycles. For the CIO, this consensus should provide the confidence to move from a wait-and-see approach to a conviction-driven allocation.

A Framework for Implementation and Risk Management

For the Endowment & Foundation CIO, a long-term strategic allocation to gold should be viewed through the lens of portfolio insurance. The recent Goldman Sachs report provides a clear risk/reward analysis for this position. The baseline forecast for gold to reach $4,000 per troy ounce by mid-2026 is driven by strong, structural central bank demand and ETF inflows supported by Fed easing and ongoing recession risk. Beyond this baseline, the composite research identifies a powerful, asymmetric upside scenario, with gold prices potentially reaching $4,500 per troy ounce or even higher in the event of a material shift by private investors; an outcome we believe is potentially more likely than some analysts are currently underwriting.

There is also important context on downside risk. The recent unwinding of speculative net long positions has removed a significant source of short-term volatility, leaving the price on a more robust foundation of central bank and ETF inflows. The only identified near-term downside risk found in the data is a geopolitical de-escalation, such as a Russia-Ukraine peace deal, which may to trigger a brief ~3% drawdown as speculators exit their positions. However, the analysis asserts that such a deal would have no lasting impact on gold's fundamental drivers, as the precedent of asset freezing and its commensurate effects on central bank positioning remains firmly in place. This dynamic presents a highly attractive risk/reward profile: limited, short-term downside risks balanced against durable structural tailwinds and asymmetric long-term upside potential.

Our final strategic recommendation is a re-stating of our prior conviction recommendation of 2022; to recognize gold as an essential, not an optional, component of a long-term, diversified portfolio. Its inclusion is a direct response to the new paradigm of financial and geopolitical risk, where traditional diversification tools may once again prove to be inadequate.

Strategic vs. Tactical Allocation: The CIO's Action Guide

Actionable Recommendations for Implementation

Immediate Actions (Next 30 Days):

Conduct a portfolio audit to identify current direct and indirect gold exposures across all asset classes and manager relationships (we would be honored to act as a resource in this endeavor). Many institutions have hidden gold exposure through commodity baskets, macro hedge funds, or real asset allocations that should be catalogued before adjusting strategic weights.

Establish a 7% strategic allocation target to gold, to be achieved through quarterly averaging over the next twelve months. This measured implementation schedule allows for tactical flexibility while ensuring strategic positioning is achieved before potential catalysts materialize.

Select implementation vehicles prioritizing physical-backed ETFs with London Good Delivery bar holdings for the core position (5% of total portfolio), supplemented by active precious metals strategies for tactical overlay (2% of total portfolio).

Medium-Term Positioning (3-6 Months):

Develop explicit rebalancing triggers tied to gold allocation weights rather than price levels. Trim positions above 10% of portfolio, add below 5%, with quarterly assessment regardless of interim movements.

Establish reporting frameworks that separate gold's strategic hedging value from short-term performance measurement. Gold allocation success should be evaluated during equity-bond correlation breakdowns, not monthly returns during risk-on periods.

Consider implementing a collar strategy (selling 20% out-of-the-money calls, buying 10% out-of-the-money puts) on 25% of the position to reduce portfolio volatility while maintaining upside participation to our $4,000 price target.

Strategic Considerations (12+ Months):

For the larger institutional investors, evaluate physical custody allocation for 20% of gold holdings through allocated accounts with established precious metals custodians. This provides ultimate counterparty risk protection and potential operational flexibility during extreme scenarios.

Develop scenario-based escalation triggers that would warrant increasing gold allocation above 10%. Key things to monitor include: Federal Reserve balance sheet expansion beyond $8 trillion, debt-to-GDP ratios exceeding 150%, or additional major economy sanctions that further fragment the international monetary system.

Create educational materials for investment committee members and stakeholders explaining gold's role as institutional credibility hedge rather than inflation hedge per se. This distinction proves crucial for maintaining conviction during periods when gold and inflation expectations diverge.

The time for incremental adjustments has passed. Institutional investors must recognize that the post-Bretton Woods III era has begun, and portfolio construction principles must evolve accordingly. Gold allocation is not about predicting catastrophe, it's about acknowledging that the institutional certainties of the past forty years no longer hold, and positioning portfolios for resilience in an uncertain future.

This table summarizes the core recommendations and provides an actionable framework for Endowment & Foundation CIOs, distinguishing between a strategic, long-term approach and a tactical, short-term one.

Contact | Connect with our Experts — Wind River Capital Strategies

Sources:

Goldman Sachs, "The Strategic Case for Gold and Oil in Long-Run Portfolios"; Goldman Sachs, "Gold Market Primer", Goldman Sachs, "Seasonal Central Bank Lull, But Gold On Firmer Ground", Goldman Sachs, "Diversify Into Commodities, Especially Gold"; J.P. Morgan Private Bank, "Is It a Golden Era for Gold?"; J.P. Morgan Private Bank, "How one client diversified his portfolio by adding gold", Fidelity International, "Gold price: the latest analysis and our fund picks", Fidelity, "How to invest in gold: 5 ways to buy and sell it”, Merrill Lynch, "Should you join the latest gold rush?", BlackRock, "Preparing Portfolios for New Market Realities", Scottsdale Bullion & Coin, "Citi Reignites $3500 Gold Target as Economic Outlook Rapidly Sours", Argaam, "Citi hikes gold forecast to $3,500 over next three months", "UBS ups long-term gold price forecast to $2800 on higher costs, strategic demand”, UBS "Daily outlook on markets and investments".